Many Construction Industry Multiemployer Pension Plans Remain in Financial Distress

Merit shop contractors are typically wary of competing for taxpayer-funded construction contracts which are subject to government-mandated project labor agreements. Often their main concern is the viability of defined benefit multiemployer pension plans, which expose their businesses to potentially catastrophic MEPP liability. Information about the health of construction industry MEPPs provided by the U.S. Department of Labor bears out those concerns.

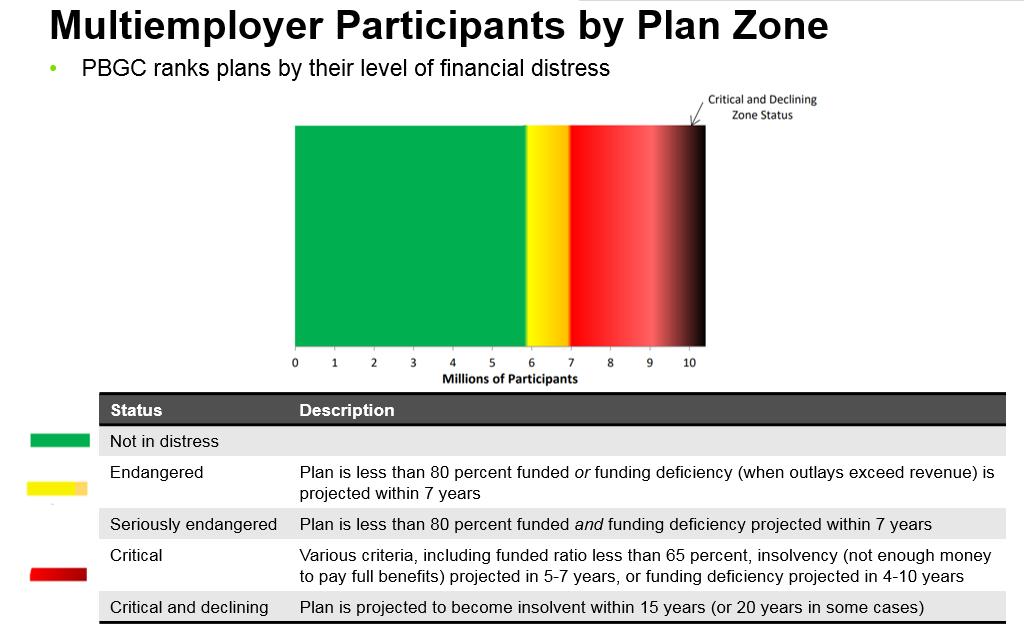

Federal law requires trustees of financially distressed MEPPs in Critical and Declining Status, Critical Status or Endangered Status to provide notice about the level of financial distress to plan participants, beneficiaries, the bargaining parties, the Pension Benefit Guaranty Corp. and the DOL no later than 120 days after the close of the plan year.

Twenty-one out of 59 MEPPs sending Critical and Declining Status Notices to plan participants in 2019 (reflecting plan performance through the end of 2018) were from the construction industry, according to a list posted by DOL’s Employee Benefits Security Administration. In addition, 48 out of 115 MEPPs sending Critical Status Notices and 39 out of 62 sending Endangered Status Notices were from the construction industry.

The health of construction industry MEPPs have shown signs of improvement compared to notices posted the prior year.

Thirty-two out of 73 MEPPs sending Critical and Declining Status Notices to plan participants in 2018 (reflecting plan performance through the end of 2017) were in the construction industry. In addition, 82 out of 129 MEPPs sending Critical Status Notices and 70 out of 80 plans sending Endangered Status Notices were in the construction industry.

“With robust construction spending, low industry unemployment and strong stock market returns throughout 2018, it is not surprising that construction industry MEPPs showed signs of improvement,” said Ben Brubeck, ABC vice president of regulatory, labor and state affairs. “However, the DOL’s information demonstrates that some, but not all, construction industry MEPPs remain in poor financial shape.”

“Because these notices are not posted on the DOL website in real time, they do not reflect generally positive plan performance in 2019, as well as generally negative plan performance in 2020, which will be impacted by diminished stock market returns, a decline in construction spending and the loss of a record 975,000 construction industry jobs in April caused by the COVID-19 pandemic,” said Brubeck. “Beneficiaries should remain vigilant about the financial health of MEPPs and promised benefits, and contractors should investigate hidden MEPP liabilities that could financially harm a business.”

Construction industry stakeholders interested in reviewing construction industry MEPPs in critical and declining, critical and endangered status from 2008 to May 7, 2020, can search this spreadsheet or visit the DOL website on MEPPs.

Defined by ERISA Code Section 305, troubled MEPPs are at risk of future insolvency, putting participants, including retirees, on an unfortunate pathway towards reduced benefits.

If MEPPs become insolvent, they are taken over by the Pension Benefit Guaranty Corp.—an independent agency of the federal government that monitors and privately insures pension benefits in private sector defined-benefit plans, such as multiemployer pension plans. Qualified individual beneficiaries may receive up to $12,870 per year in defined benefits in certain circumstances.

However, because of a number of factors, including exposure to struggling MEPPs, the PBGC is projected to become insolvent around 2025, after which it will not be able to pay guaranteed benefits for insolvent MEPPs.

According to data from the PBGC, the construction industry is a major contributor to current MEPP underfunding and future PBGC MEPP insurance program funding shortfalls:

• According to the PBGC’s 2017 Pension Insurance Data Tables, which contains the most recent PBGC data on industry MEPPs, construction industry MEPPs are responsible for about $311 billion (or 48.7%) of all PBGC-insured MEPP underfunding, which totals $639 billion. (See Table M-14: Funding of PBGC-Insured Plans by Industry (2016) Multiemployer Program).

• The amount of the construction industry’s MEPP underfunding continues to grow. In comparison, Table M-14 of the 2010 PBGC report indicates the construction industry’s portion of all PBGC-insured MEPP underfunding grew to $167 billion (or 47%) in 2009.

• 762 (55.4%) of the 1,375 MEPPs insured by the PBGC are in the construction industry. (See Table M-8: PBGC-Insured Plans and Participants by Industry (2016) Multiemployer Program).

• The construction industry comprises $546 billion (49.4%) of the PBGC’s total liabilities. (See Table M-14: Funding of PBGC-Insured Plans by Industry (2016) Multiemployer Program).

• The largest number of employees from any industry, almost 3.83 million (36.6%) of the 10.465 million PBGC-insured MEPP participants (workers and retirees), is from the construction industry. (See Table M-8: PBGC-Insured Plans and Participants by Industry (2016) Multiemployer Program).

MEPPs and the Construction Industry

All MEPPs are defined by the Taft-Hartley Act of 1947. Typically, construction industry contractors that have signed a collective bargaining agreement with a building trades union(s) pay into a MEPP fund that is managed jointly by trustees from the specific trade union and select representatives from employers signatory to that union. MEPPs provide defined retirement benefits to participating workers who have met vesting schedules and other requirements during their career.

In general, unionized construction firms use a defined benefit MEPP retirement model, while nonunion contractors typically provide defined contribution plans such as a portable 401(k) retirement plan.

“Nonunion contractors are extremely cautious about contributing to MEPPs because it can expose their business to future unknown pension liabilities, and many MEPPs are unlikely to help construction workers achieve their retirement goals,” said Brubeck. “They know the MEPP model is flawed and the risks to companies and beneficiaries are just too great to participate and prefer utilizing alternative retirement vehicles.”

During the great recession, many contractors participating in MEPPs went out of business. These contractors failed to pay their share of liability to a MEPP, creating additional liability for a MEPP’s remaining employer participants, which caused insurmountable financial burdens on contributing employers and/or forced the PBGC to take over the plan and cut benefits.

In addition, lawmakers have pushed construction industry contractors and workers into MEPPs via so-called responsible contractor laws and government-mandated PLAs on taxpayer-funded construction projects that can expose contractors to MEPP liability and harm retirement prospects for its workforce.

An October 2009 report by St. Louis University accounting professor Dr. John R. McGowan, “The Discriminatory Impact of Union Fringe Benefit Requirements on Nonunion Workers Under Government-Mandated Project Labor Agreements,” found nonunion workers’ take-home pay is reduced by at least 20% when their employers enter into PLA arrangements containing a MEPP requirement.

In addition, nonunion construction workers subject to a PLAs’ MEPP participation language may lose all contributions made to a MEPP during the life of a project unless they join a union, pay union dues and meet the plan’s vesting requirements.

“Lawmakers should not be forcing construction workers and businesses into a broken and flawed MEPP scheme at the urging of their political benefactors,” said Brubeck. “If lawmakers were aware of the health of troubled union-affiliated MEPPs, they might be less likely to require government-mandated PLAs and so-called responsible contracting policies that mandate participation in MEPPs on taxpayer-funded construction projects.”

Congressional Outlook for MEPPs and the PBGC

Lawmakers in Washington have been working on ways to protect the benefits promised to participants in multiemployer pension plans.

Last year, the U.S. House of Representatives and Senate laid out blueprints with very different visions for solutions and failed to reach any agreement on a way forward.

Congress did slip a rescue package into the $1.4 trillion spending bill passed at the end of 2019 for one non-construction industry MEPP plan close to failure, sponsored by the United Mine Workers of America. However, the House and Senate remain deeply divided on how to solve the broader problem.

There have been campaigns by some MEPP stakeholders to facilitate federal assistance to the PBGC and struggling MEPPs in future economic assistance packages in response to the COVID-19 pandemic.

ABC will continue to monitor all legislative proposals concerning the PBGC and MEPPs and will continue to oppose government-mandated PLAs and other laws mandating contractor and employee participation in MEPPs.

Construction industry stakeholders interested in reviewing construction industry MEPPs in critical and declining, critical and endangered status from 2008 to May 7, 2020, can search this spreadsheet or visit the DOL website on MEPPs.